Disclaimer:

This guide provides educational and general principles and in no way represents a proposal, legal advice or specific recommendations as to any party which may obtain it. In this guide, the treatment of the law is non-specific and is not intended as a comprehensive discussion of all relevant issues that may be involved in your situation. You are strongly urged to seek the advice of experienced legal counsel to review your specific goals, financial situation, and circumstances. All warranties as to this guide are hereby expressly disclaimed, and absolutely no liability will accrue to any party that drafted or is providing this guide to any person or entity resulting from any use of the information contained herein. You hereby release and hold harmless the drafter of this guide and any provider of this guide for any financial or other loss that may occur as a result of the recipient’s utilization of any information contained herein. Your use of any information contained in this guide is carried out solely at your own risk, and you are again cautioned to consult legal professional before doing so. If you have any questions, please contact us at bruce@bbbusinesslaw.com.

What is Asset Protection?

Asset protection includes three categories: lawsuit protection, tax reduction, and estate planning. There are strategies you can use to protect your professional and personal assets against lawsuits. There are strategies you can use to reduce your taxes. There are strategies you can use to effectively pass your estate to the heirs you select. You must understand the strategies and tools used in all three categories and how they interrelate to set up an effective total asset protection plan. This guide provides you with a generalized overview of the strategies and tools that are available to help you protect your assets against lawsuits. If you have available and reachable assets, it is not a matter of if you will be sued, but when.

Premise Liability

In 2017, over 50,000 personal injury cases were filed. Property owners make a more attractive target than the perpetrator in most cases, since the owner is easy to locate and generally will have insurance. For this reason it is extremely important to prepare your commercial property to face potential liability, not only from unknown 3rd parties, but from the owner’s personal creditors, business partners’ liabilities, and perhaps even (former) family members. Generally, a multi-pronged approach would be deemed as the most prudent course of action, which includes planning the proper ownership structure for your assets (including anonymity and isolation techniques), obtaining proper insurance coverage (including ensuring that the standard of care with respect to the management property is commensurate with the type of property), and the use of knowledgeable and creative legal counsel who will be able to properly shield the individual owner from being identified, acting as an intermediary in business matters, and potentially settling or preventing a litigation event from happening and adding to the owner’s potential exposure. Other important topics are addressed below as well.

Financial Privacy

There are aggregator services which personal injury attorneys, family attorneys, and creditors use to obtain detailed financial information reports on just about anyone who may be a target for a lawsuit and which describe in detail all of the target’s bank accounts, assets, real and personal property, marital information, and a great deal of other significant information. We all know there is little to no real privacy these days. Such reports are in addition to highly intrusive forensic accounting specialists who are sometimes employed in some lawsuits to comb through all electronic records of a defendant. Information from Amazon, Facebook, Google and other accounts is widely available to governments and other private parties for purchase who then resell that information. The goal of asset protection is to isolate personal assets from business assets and to segregate and isolate business assets into as many separately protected units as may be necessary to reduce the risk of one business asset adversely affecting another business asset in the event legal risk materializes for any such business asset.

Entity Structure Planning

An LLC is always the best way of holding real property, the reasons for this fact are numerous and well settled, and this guide is too brief to go in depth on this point. Depending on the value of the real estate in question, the general plan should be to have 1-2 properties in a single LLC, but usually not more than 3, unless they are very low risk assets with substantial insurance coverage (Class A properties). In most instances the best course of action is a single property per LLC.

Presently a new type of LLC is being experimented with in Texas called the “series LLC”. This type of entity is like having multiple LLCs in one, each being called a series (series A, B, C, etc.) Each series must be treated as a separate entity to maintain its liability protections, and may have different ownership, distribution interests, voting rights, management, and any other governance agreed to by the owners. This type of entity is too new and untested in litigation to recommend its use with commercial, high value assets. It is unknown to what extent the assets and liabilities must be segregated to maintain protection. It is simply too risky to own a property in each series when the risk that a court may pierce the veil of liability protection is unknown and may occur for any reason; while regular LLCs have extensive case law and offer far more predictable treatment by courts. Each series would need its own bank account, operating agreement, and would need to be treated as a separate company; therefore, the prudent course of action would dictate spending a few hundred dollars extra to just go ahead and form totally separate entities and ensure a piece of mind. This is not to say there is no use case for a series LLC, which can possibly be used in very low risk situations such as to hold numerous individual business property assets or enter into agreements.

Since Texas is rather nosy with regard to entity ownership, each LLC that owns a property should further be owned by another out-of-state LLC holding company which permits anonymous ownership, such as Delaware or Wyoming. New Mexico is an option, but their LLC laws are not as well developed as the others. Furthermore, it should be noted that no asset protection or anonymity plan is impenetrable; there are always ways of getting the name(s) of the owner(s) if one digs hard and long enough. The goal here is to create as many barriers and to increase cost to the greatest extent possible prior to initiating a legal action so as to dissuade the potential plaintiff from continuing with its efforts. Ideally the holding company should have no bank accounts, EIN, or enter into any contracts, as this would force disclosure of principals and would likely wind up on some private discoverable database.

A technique which has worked well in Texas is to use a trust to own an LLC as its ‘member’ and the LLC as the beneficiary of the trust, which works well in situations where a company would not be required to reveal its private trust document to 3rd parties. For example in financing situations, the lender would definitely request all trust documents before granting a loan (same as all governing documents of a parent LLC), and a personal guarantee would still be required from the trustee or settlor (creator of the trust). Certainly when selling a property all governing trust or LLC documents would need to be revealed and an LLC works better in this regard as it makes a buyer’s due diligence process easier. Lenders and buyers are used to seeing holding companies but not so much ownership trusts, this may make obtaining a loan more difficult. In the event of creditor action against the trust owned LLC, the trust agreement should stipulate that the trustee has the right to appoint a successor trustee to maintain anonymity who may then transfer the LLC assets to another LLC (risky, therefore in limited situations), to terminate the trust, or to remove the trust to another jurisdiction. It should be noted that regardless if an LLC is owned by a trust, all the other types of LLCs listed below should still be utilized, there is no way around it; these include management company to enter agreements and collect rent, IP holder LLC, and business property owner LLC.

The required annual Public Information Report works equally well with trusts or parent LLCs. The drawback to using a trust is that a trust provides no legal protection except for the LLC itself, and the trustee is generally named as defendant in suits for actions of the trust and may certainly be named as defendant in a claim against the LLC since the LLC is property of the trust and a plaintiff will usually fire off as many causes of action as possible to induce panic and have as many avenues to a favorable judgment as possible. This scenario is not possible with an LLC parent since there is no contractual privity with the parent: only the subsidiary may be sued directly. Furthermore it’s easier to obtain 3rd party signatories for agreements by use of the parent/subsidiary LLC structure, since the trustee, who is attempting to maintain anonymity and is also the principal would generally need to sign all legal documents, short of a power of attorney or engaging of a 3rd party specifically for this purpose.

Any service of process from a plaintiff would be served on the registered agent of the Texas LLC which would go to the trustee who would have to answer the suit or risk default judgment against the entity and the trustee personally. With a parent holding company, the process would go to the parent company which would then have a few options as to how to respond, if at all.

Occasionally an additional extra layer of protection may be required in some situations where an offshore entity (likely another LLC) may be utilized to own 100% of the holding company. Such a triple entity structure is nearly impenetrable with respect to liability. The offshore entity becomes the main holding company and may also own other offshore entities which hold assets, but should not directly hold assets itself. The operating agreement of this entity would stipulate that should legal action be implemented against it, the manager member may terminate the company and remove its assets (U.S. holding company) to another jurisdiction. There would be no way to invalidate this action.

Additional Entities Necessary

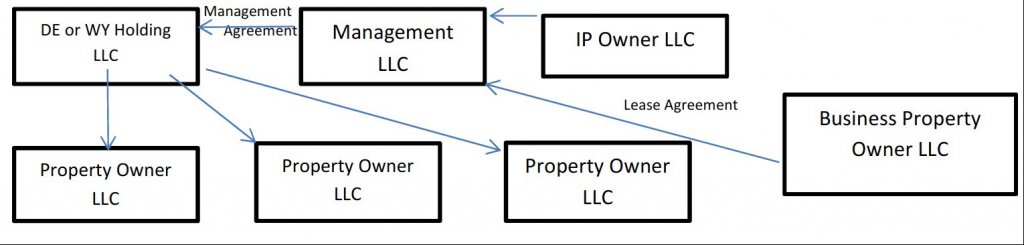

The above only covers entities which actually hold real property. Additional companies should be formed to carry out actual business activities. This would be the management company that is the public face of the investor and enters into all agreements with service providers, vendors, staff, collects rent, is sued, and the like. This activity should not be carried out through the holding company, but should be a totally separate, stand-alone LLC with a management agreement executed between the parent holding LLC and this management entity. This entity would be minimally capitalized at all times.

Business property (furniture, equipment etc.) should further be owned by an additional separate LLC and leased back to management LLC for use by each property holding LLC. This way any injury by equipment or other personal property, such as a vehicle, would only endanger the company that owns it, not the company that owns a given building and is using the property in its business. It should be noted that under the principles of respondeat superior and vicarious liability, the management LLC would likely also be sued for acts of employees during the course of employment, therefore the management company should also have adequate insurance coverage.

Intellectual property is also a valuable asset and should not be mingled with any other company, but any copyrights, trademarks and patents should be placed in their own separate LLC (or even multiple LLC, depending on their value) and licensed to the management company for use by each property owning entity.

Diagram of LLC Plan

Diagram of Trust Owner Plan

Insurance Coverage Plus

The above is a basic description of entity planning which is an important but not perfect method to attempt asset protection. The cornerstone of any asset protection plan is having sufficient high-quality insurance commensurate with the amount of risk borne by the owner of a given property. The insurer should be well established, stable and not at risk of going under with a large claim from any source. Title insurance, property insurance, business insurance, worker’s comp, business interruption insurance are all additional safety nets and part of a solid asset protection plan.

The building management company, maintenance company, security company, and janitorial staff should generally all be 3rd party contractors with their own insurance policies that would cover their employees/contractors in the event of potential liability. For example, in the event of injury from criminal activity and resulting litigation a property owner will generally be imputed with the requirement to having maintained a safe and secure property with regard to the generally known crime rate of the area where the property is located; therefore the higher the crime rate the greater the number of security staff and other security measures the building should have (greater access restrictions, doors, gates, pass cards, video recorder cameras etc.)

Business Partners

Having business partners is in many cases a necessity to maximize financial rewards, and may also unfortunately plant the seeds of destruction of the venture as the liabilities of a given partner may become the liabilities of the business, or the ownership interest of the partner may become a target for seizure, thereby disrupting the business activity of the venture and creating unnecessary financial burdens on all parties involved in the business.

For this reason it is necessary to extensively vet anyone with whom a venture is commenced, meaning their financial and credit status, outstanding debts, liens, marital situation, and other potential liabilities should be ascertained. The primary and most effective step in isolating business partner liabilities is to ensure that various creditor repelling measures are inserted into the holding company’s operating agreement, which may include provisions such as a limitation on the rights a creditor may obtain through a charging order against a given member of the LLC (no management rights but only distributions), remaining members’ buyout rights for a reduced price of the creditor’s LLC interest obtained by judgment or court order, a release by the spouse of each member that the LLC interest is a member’s separate property and the spouse will not be entitled to any interest or management rights upon death or divorce (except through testamentary grants), right by members to transfer LLC assets to another entity or jurisdiction for any reason, buyout rights by the LLC of the debtor member’s interests upon any notice of that member’s potential liability (such notice being mandatory), right to assign or reject any distributions by any member, discretion by members as to how and when to make distributions, and other similar provisions.

Once litigation is commenced by any creditor, that party’s counsel will of necessity seek all financial documents of the debtor through discovery, which will require the defendant/debtor/member to disclose the operating agreement, which is a good thing. Once the plaintiff realizes that even by proceeding with the entire claim through judgment and obtaining a charging order (the sole creditor remedy in Texas) the creditor is extremely unlikely to ever obtain any cash whatsoever, the decision by the plaintiff’s legal counsel will be very easy to make: the claim against the LLC will be dropped. Obviously if the debtor has other assets which may be reached, besides the LLC interest, then of course they may be pursued, but the LLC interests will be safe and business activity may continue unabated, with no disruptions. If a charging order is still obtained then the managing member(s) may freely implement some of the operating agreement’s provisions to ensure that no payments are ever paid to the creditor, this is easy and entirely legal to do, and the creditor may in fact be required to pay taxes on paper gains while not actually receiving any amount of money. The creditor can never have any management rights or seek foreclosure of any LLC interests or sell any LLC assets.

Equity Stripping

Under U.S. secured transactions laws of the UCC, generally a perfected prior lien will have priority over all subsequent liens in a foreclosure; therefore having a solid first and/or second lien which may be used in the event of creditor attack is a very worthwhile endeavor. Generally the first lien will be the purchase mortgage or deed of trust from the lender, and as equity increases there may be a need to protect that equity through new liens. While there are many ways to equity strip a commercial property, the most efficient is generally considered an equity line of credit loan (ELOC). Such a loan does not need to be used or paid interest on, unless the borrower wants to do so, and should be taken out long before any potential creditor threat to avoid a successful challenge. The proceeds may be invested in other properly shielded property or used to purchase ultra-safe offshore assets. Other methods to equity strip include LLC capitalization liens, landlord/tenant liens (if the property owner is using his own building), or any other legitimate lien where cash or other items of value are exchanged. All the above methods are complex and should not be attempted without qualified assistance.

Such lien placement will place another very substantial barrier between a creditor and pursuit of a judgment, and create a high likelihood that a plaintiff attorney will decide to forego the claim if the claimant would need to wait until the property is sold or foreclosed to possibly collect a small portion of the amount of the outstanding obligation or have its lien wiped out entirely and receive nothing.

Land Trusts

Unfortunately Texas does not have a separate land trust statute like Florida and Illinois; however, all goals accomplished by a land trust may also be accomplished by use of LLCs. Texas trusts are governed by the Texas Trust Code and do not offer the same protections as in the other states; therefore no matter what anyone say there is no such thing as a statutory “land trust” in Texas. There are few situations where a trust may be used to transfer property interests as trusts are not legal entities and do not offer liability protection. Some uses for these vehicles are privacy requirements, estate planning (succession of ownership), simplification of transfer (multiple owners consolidated under trustee and trust interests are personal property; no deed recording transfer is required). Again, Texas trusts should generally be used in limited situations, only used for temporary property ownership, and/or used to shield a particular transfer from appearing in county records in between transfers to a legal entity such as an LLC. Of course, LLC interests may also be transferred the same way, without any public disclosure, and LLCs are also an effective estate planning tool.

Legal Counsel

Certainly the most essential tool in an asset protection strategy is a knowledgeable and creative legal counsel who can tailor the plan to an investor’s particular needs and potential risk. Is there a high risk property where there is substantial risk of litigation by a tenant or invitee? Is a business partner involved in a separate high risk venture where there is significant risk of that partner being sued for their interest in a company and the plaintiff may seek partition of the property or to obtain control of that partner’s interest in the LLC? Is there a potential marital dissolution on the horizon where the spouse may demand a share or control of the business or property? Are there tax liens on other property held by an investor and there is significant need for anonymity for this and other reasons, such as other potential creditors? All these issues require a custom strategy implemented so as to maximize the likelihood that assets will not be discoverable, and if discovered the burdens to get to them would be so high that the pursuit would not be worthwhile to a creditor and his attorney.

Above and beyond the planning and implementation of an asset protection strategy, an attorney may also act as an agent for a given entity or a trust, such as being an authorized signatory on contracts, a negotiator in disputes, a representative in business deals and litigation, and as attorney in fact in certain situations. Dependable counsel is an indispensable asset who can build that wall between an investor’s valuable assets and those who would seek to confiscate them for any number of reasons, which many times may in fact be nefarious and opportunistic: just because they can and the investor has the deepest pockets of all other potential defendants.