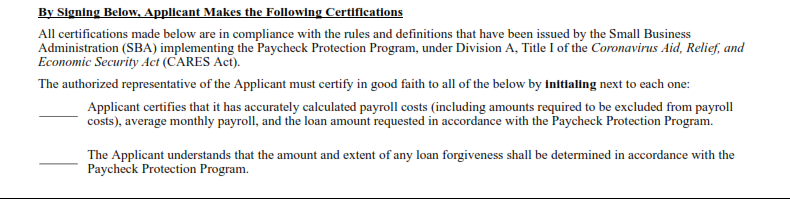

Simply put it potentially may be both. The SBA doesn’t make loans it only guarantees them. It’s up to their affiliated lenders to qualify, process and administer SBA loans. The lender will decide if the conditions have been met for the loan to be forgiven. Generally speaking banks hate making these loans because they lose money on them; no closing/admin costs, and the rate is 1% which is below inflation rate. So you can expect that they will enforce the terms strictly for qualification and forgiveness. Let’s look at the supplemental to the PPP application:

As you can see there is no mention of loan forgiveness here, but this section does refer to the CARES Act which has the rules for the PPP loan forgiveness program outlined in Section 1106. Moreover, the signatory is certifying the accuracy of information provided to the lender and if there are any inaccuracies, it can be assumed that the lender will not provide the loan and/or will not forgive it; therefore, accuracy and record keeping are imperative.

The CARES Act states as follows:

SEC. 1106. LOAN FORGIVENESS.

(b) FORGIVENESS.—An eligible recipient shall be eligible for forgiveness of indebtedness on a covered loan in an amount equal to the sum of the following costs incurred and payments made during the covered period:

(1) Payroll costs.

(2) Any payment of interest on any covered mortgage obligation (commercial mortgage; payment of principal not forgivable)

(3) Any payment on any covered rent obligation. (Commercial rents)

(4) Any covered utility payment. (Electric, water, internet, etc.)

(c) TREATMENT OF AMOUNTS FORGIVEN.—

(1) IN GENERAL.—

Amounts which have been forgiven under this section shall be considered canceled indebtedness by a lender authorized under section 7(a) of the Small Business Act (15 U.S.C. 636(a)).

(3) REMITTANCE.—

Not later than 90 days after the date on which the amount of forgiveness under this section is determined, the Administrator shall remit to the lender an amount equal to the amount of forgiveness, plus any interest accrued through the date of payment.

(The lender is paid by SBA for any amounts forgiven under PPP)

(d) LIMITS ON AMOUNT OF FORGIVENESS (NOT PRINTED VERBATIM)

-Forgiveness will be reduced by number of full-time employees reduced.

-Forgiveness reduced if full-time employee salaries cut.

-Wages paid to tipped/commissioned employees may count towards forgiveness amount.

-LENDER TO DECIDE ON FULL, PARTIAL, OR NO FORGIVENESS WITHIN 60 DAYS OF DOCUMENT SUBMISSION BY BORROWER.

-ANY AMOUNTS FORGIVEN ARE NOT INCLUDED IN GROSS INCOME/NOT TAXABLE=GIFT.

Obviously, there is a lot of additional information contained in the CARES Act, you are encouraged to consult a professional for assistance with the PPP, loan forgiveness, etc. The assumption is that the Act will be strictly enforced, so you should maintain detailed and complete records of all payroll and other expenses as to where the SBA loan amounts go, including your business tax returns.